Introduction

In 2024, the shekel, Israel’s national currency, has been facing significant volatility due to escalating tensions and potential conflict with Lebanon. This article provides a comprehensive analysis of how these geopolitical concerns have impacted the shekel, the broader economic implications, and potential future scenarios.

Background: Tensions with Lebanon

The relationship between Israel and Lebanon has been historically fraught with tension, primarily due to territorial disputes and political differences. In 2024, these tensions have intensified, leading to heightened fears of a full-scale conflict.

Historical Context: The Israel-Lebanon conflict has its roots in the 1948 Arab-Israeli War, with multiple conflicts, including the 1982 Lebanon War and the 2006 Lebanon War, further exacerbating hostilities.

Recent Developments: In recent months, increased military activity along the Israel-Lebanon border and inflammatory rhetoric from political leaders have stoked fears of another war. The presence of Hezbollah, a powerful militant group in Lebanon, adds to the complexity and volatility of the situation.

Impact on the Shekel

The shekel’s value is sensitive to geopolitical stability. As fears of war with Lebanon rise, the shekel has experienced notable depreciation against major currencies like the US dollar and the euro.

Market Reaction: Investors tend to flee to safer assets in times of geopolitical instability. As a result, there has been a significant sell-off of the shekel, causing its value to drop.

Central Bank Response: The Bank of Israel has intervened to stabilize the currency, including measures such as adjusting interest rates and direct market interventions. However, these efforts have had limited success due to the persistent uncertainty.

Inflation Concerns: The depreciation of the shekel has raised concerns about inflation. As the cost of imports rises, prices for goods and services within Israel are likely to increase, impacting consumers and businesses alike.

Economic Implications

The potential conflict with Lebanon and the resultant impact on the shekel have broader economic implications for Israel.

Investment Climate: The uncertain geopolitical environment has made investors wary, potentially leading to a slowdown in foreign direct investment (FDI). Investors prefer stable environments, and the threat of war can deter investment decisions.

Trade and Commerce: Lebanon is a minor trade partner for Israel, but regional instability can disrupt broader trade routes and economic activities. This disruption can have ripple effects on various sectors, including technology, agriculture, and manufacturing.

Tourism Industry: Israel’s tourism industry, a significant contributor to the economy, is particularly vulnerable to perceptions of safety. Heightened tensions and the threat of conflict can lead to a decline in tourist arrivals, affecting revenue and employment in the sector.

Government Spending: The prospect of war necessitates increased defense spending. This reallocation of resources can impact other areas of public expenditure, including infrastructure development and social services.

Potential Future Scenarios

The future of the shekel and Israel’s economic stability largely hinges on the evolution of the conflict with Lebanon.

Diplomatic Resolution: If diplomatic efforts succeed in de-escalating tensions, the shekel could stabilize and regain some of its lost value. A peaceful resolution would also bolster investor confidence and improve the overall economic outlook.

Prolonged Uncertainty: Continued uncertainty without a clear resolution can keep the shekel under pressure. Persistent geopolitical instability may lead to prolonged economic challenges, including inflation and reduced investment.

Full-Scale Conflict: In the worst-case scenario of a full-scale conflict, the economic impact could be severe. The shekel would likely depreciate further, inflation could soar, and the economic disruption would be widespread, affecting all sectors.

Conclusion

The shekel’s depreciation amid fears of a potential war with Lebanon underscores the profound impact of geopolitical stability on economic indicators. As Israel navigates this challenging period, the actions of the government, the Bank of Israel, and the international community will be crucial in determining the future trajectory of the shekel and the broader Israeli economy. For now, investors, businesses, and citizens are bracing for continued volatility and hoping for a peaceful resolution to the ongoing tensions.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.info/en-IN/register-person?ref=UM6SMJM3

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

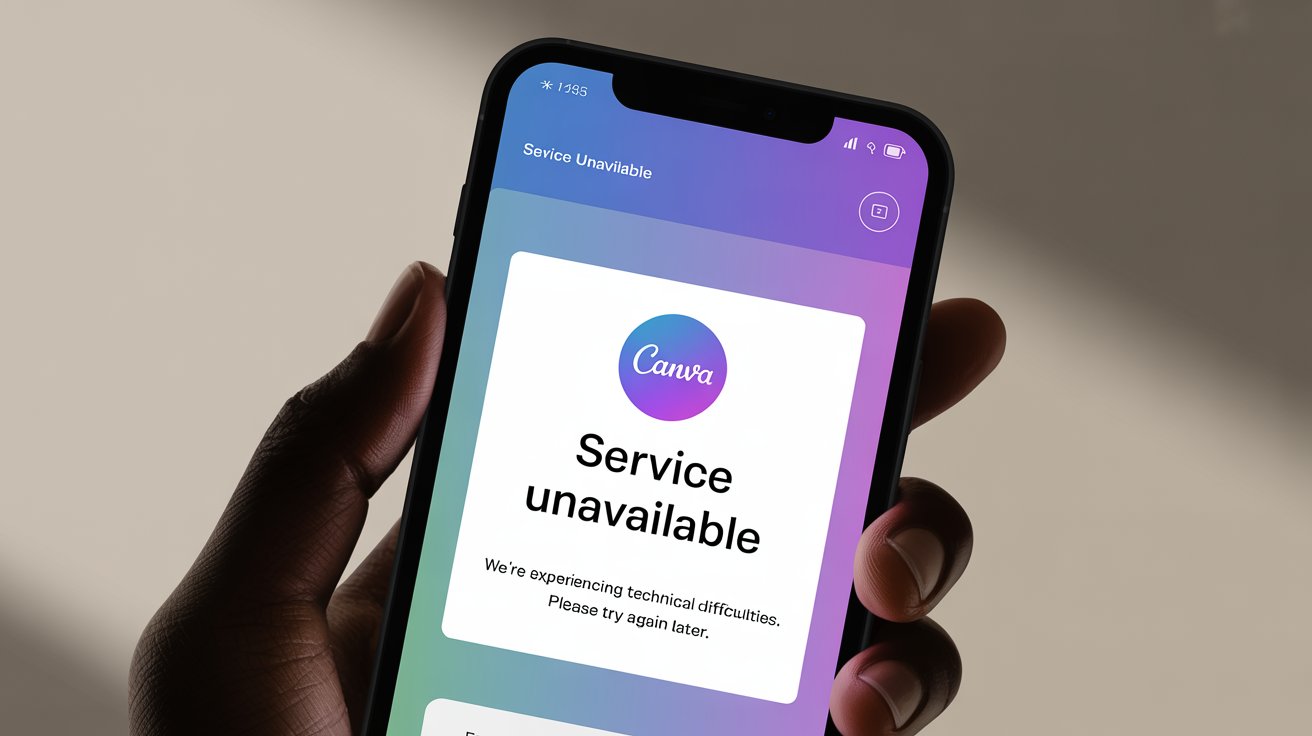

Hey just wanted to give you a brief heads up and let you know a few of the pictures aren’t loading properly. I’m not sure why but I think its a linking issue. I’ve tried it in two different browsers and both show the same outcome.

Hi there! This post couldn’t be written any better! Reading through this post reminds me of my previous room mate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing!

There is noticeably a bundle to identify about this. I think you made various nice points in features also.