Introduction

In 2024, Laurentian Bank of Canada faced a significant IT outage that disrupted its operations and affected many customers. As technology continues to play a crucial role in banking, such disruptions can have far-reaching consequences. This article provides a detailed look into the incident, its impact, and the measures taken to address and prevent future occurrences.

Background on Laurentian Bank

Laurentian Bank of Canada, founded in 1846, is one of the country’s oldest financial institutions. Headquartered in Montreal, Quebec, it serves a diverse range of clients, including individuals, small and medium-sized businesses, and commercial clients. The bank has a reputation for innovation and customer service, leveraging technology to enhance its offerings.

The IT Outage Incident

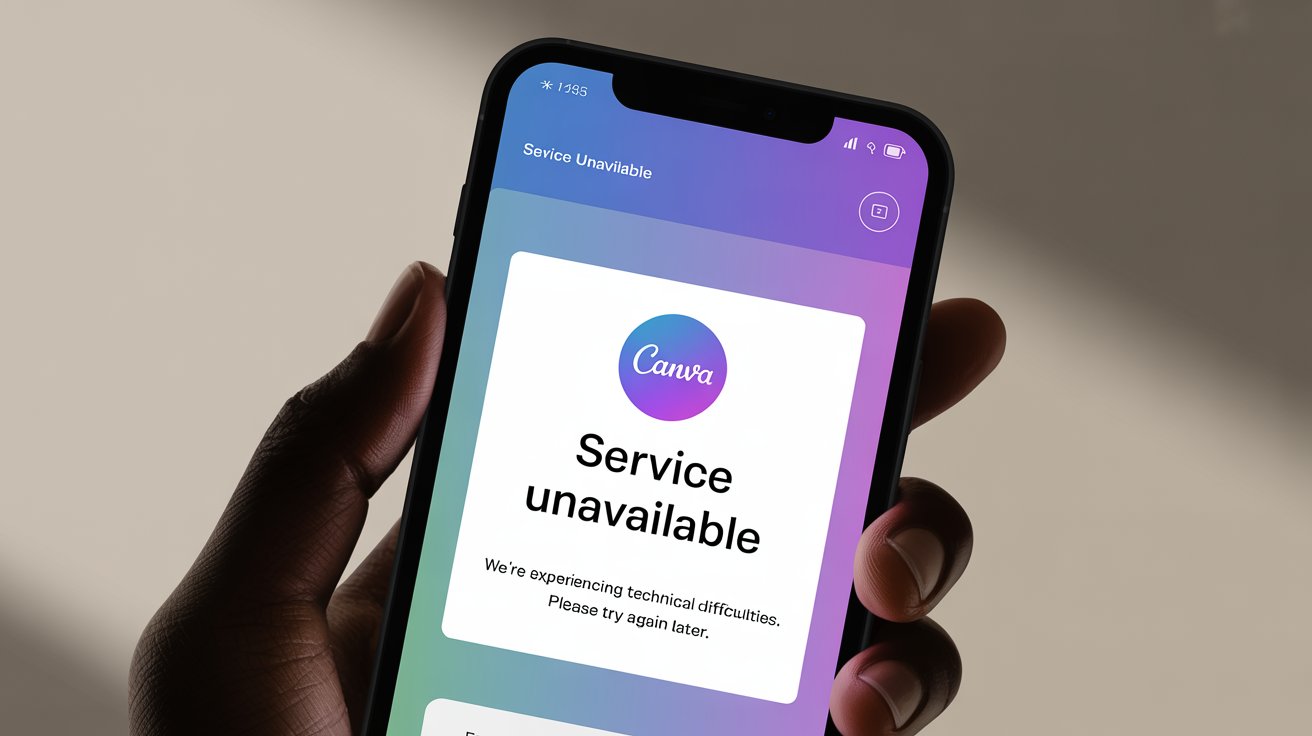

In early 2024, Laurentian Bank experienced a major IT outage that lasted several days. The disruption began on a weekday morning, affecting online banking, mobile apps, ATMs, and in-branch services. Customers were unable to access their accounts, perform transactions, or receive timely updates from the bank.

Immediate Impact

Customer Inconvenience: The outage caused significant inconvenience to customers. Many were unable to pay bills, transfer funds, or access essential banking services. This led to frustration and anxiety among customers who rely on the bank for their daily financial needs.

Business Operations: Small and medium-sized businesses that depend on Laurentian Bank for transactions and cash flow management faced disruptions. This impacted their ability to operate smoothly and meet financial obligations.

Reputation Damage: The outage tarnished the bank’s reputation. In today’s digital age, reliability and security are paramount, and the inability to provide uninterrupted services raised concerns among clients about the bank’s technological infrastructure.

Bank’s Response

Laurentian Bank responded swiftly to the outage. The management team issued public statements acknowledging the issue and assuring customers that they were working around the clock to resolve it. Key steps taken included:

Technical Teams Deployed: The bank’s IT and cybersecurity teams, along with external consultants, were mobilized to identify the root cause and restore services as quickly as possible.

Customer Communication: Regular updates were provided through the bank’s website, social media channels, and email to keep customers informed about the progress and expected timelines for resolution.

Temporary Solutions: To mitigate the impact, the bank offered temporary solutions such as fee waivers, extended deadlines for payments, and alternative methods for accessing funds.

Root Cause Analysis

The bank conducted a thorough investigation to determine the root cause of the outage. Preliminary findings indicated that the issue stemmed from a software update that inadvertently disrupted critical systems. The update, intended to enhance security and functionality, contained a flaw that triggered the widespread outage.

Lessons Learned and Future Prevention

The incident prompted Laurentian Bank to reevaluate its IT strategies and infrastructure. Key lessons learned included:

Enhanced Testing Protocols: The bank committed to implementing more rigorous testing protocols for software updates to prevent similar issues in the future. This includes extensive pre-deployment testing in simulated environments.

Improved Disaster Recovery: Enhancing disaster recovery plans became a priority. The bank is investing in redundant systems and backup solutions to ensure that services can be quickly restored in the event of future outages.

Customer Support Improvements: The bank recognized the need for better customer support during crises. Plans are underway to establish dedicated support lines and enhance communication channels to provide timely assistance and information during outages.

Industry Perspective

The IT outage at Laurentian Bank highlights the broader challenges faced by the banking industry in managing complex technological infrastructures. As banks continue to digitize their services, the risk of technical failures and cybersecurity threats increases. Industry experts emphasize the importance of:

Robust Cybersecurity Measures: Protecting against cyber threats requires continuous investment in advanced security technologies and practices.

Continuous Monitoring: Implementing real-time monitoring systems to detect and address issues before they escalate is crucial.

Customer Trust: Maintaining customer trust through transparency, reliability, and prompt resolution of issues is essential for long-term success.

Conclusion

The IT outage at Laurentian Bank in 2024 serves as a reminder of the critical role technology plays in modern banking and the potential impact of technical disruptions. While the incident caused significant inconvenience, the bank’s proactive response and commitment to improving its systems demonstrate its dedication to serving its customers effectively. As the banking industry evolves, continuous improvements in technology, security, and customer service will be key to preventing and managing future challenges.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.